Aspect Business Communications – Managed IT Support & Leasing Solutions

Empowering Your Business with Managed IT Support

At Aspect Business Communications, we provide comprehensive managed IT support and leasing solutions to help your business thrive in a competitive digital landscape. We provide a wide range of flexible payment options to ensure that all our customers have access to the IT they need without impeding on cash flow or requiring huge up front investments.

Why Lease Your IT Equipment?

Leasing is a smart, cost-effective way for businesses to access the latest technology without the upfront costs. Here’s how leasing with Aspect Business Communications can benefit your business:

- Affordable Access to the Right Equipment

Leasing allows you to acquire the IT equipment your business needs without a significant capital outlay. Spread the cost over manageable monthly payments, preserving your cash flow for other critical areas. - Plan for Future Technology Refreshes

Technology evolves rapidly, and leasing ensures your business stays up-to-date. With flexible lease terms, you can easily upgrade to newer equipment at the end of your lease, avoiding the hassle of outdated technology. - Flexible Payment Options

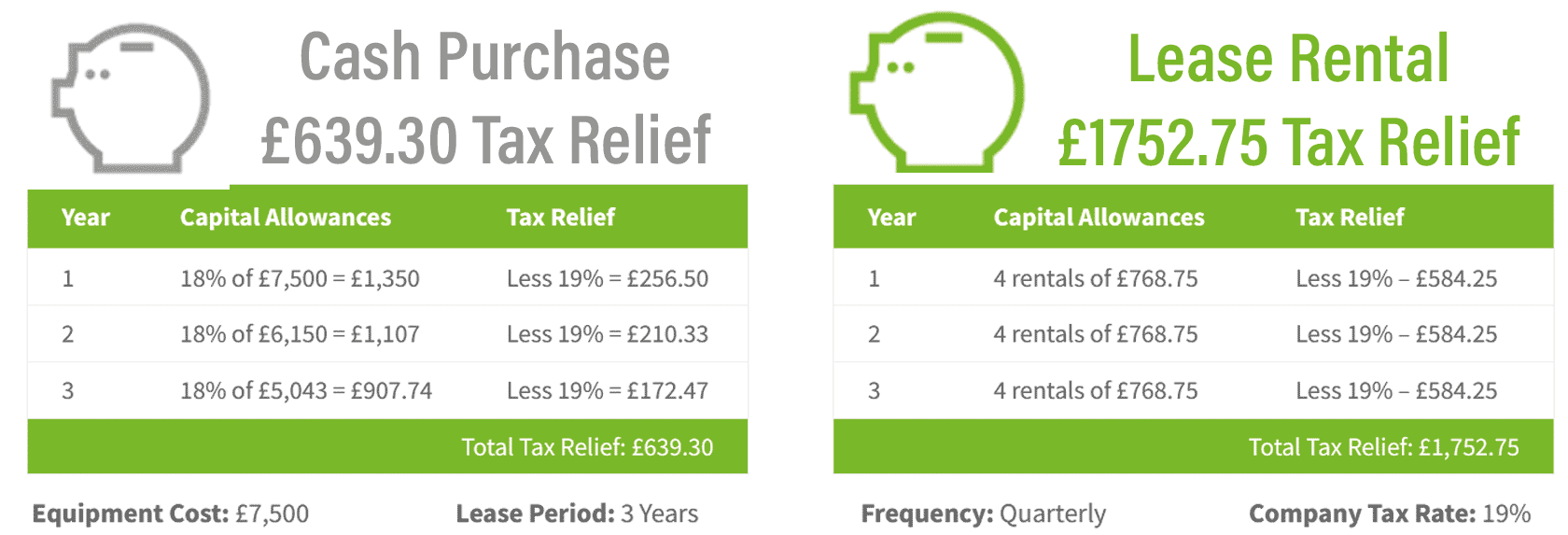

We offer tailored leasing solutions to suit your budget and business needs. Whether you prefer fixed monthly payments or seasonal adjustments, we work with you to create a plan that aligns with your financial goals. - Tax and Accounting Benefits

Leasing can offer potential tax advantages, as lease payments are often considered operational expenses. This can help reduce your taxable income and simplify your accounting processes. - No Obsolescence Risk

With leasing, you’re not stuck with outdated equipment. At the end of your lease term, you can upgrade to the latest technology, ensuring your business remains competitive and efficient.

When you lease equipment, the monthly lease payments are typically treated as an operating expense. This means they can be deducted from your taxable profits, reducing your overall Corporation Tax liability. For example, if your business pays £500 per month in lease payments, this £6,000 annual expense can be deducted from your taxable profits, potentially saving you money on your tax bill.